Land depreciation calculator

Ad Explore Land Ownership Info Flood Maps Soil Analysis And More. This depreciation calculator is for calculating the depreciation schedule of an asset.

How Is Property Depreciation Calculated Rent Blog

Chemicals - Expenses related to chemicals such as herbicide.

. How to Calculate Depreciation in real estate. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Receive a guaranteed highest price quote for your junk car by filling in the form online.

By entering a few details such as price vehicle age and usage and time of. Calculate car depreciation by make or model. Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as Depreciation.

The smart depreciation calculator that helps to calculate depreciation of an asset over a specified number of years also estimate car property depreciation. Call us now 855 547-1550. Use this depreciation calculator to forecast the value loss for a new or used Land Rover.

Find and analyze plat maps with more data and insights in one easy to use tool. Our Land Rover depreciation calculator. The four most widely used depreciation formulaes are as listed below.

Your basis in your property the recovery. Straight Line Depreciation Method. C is the original purchase price or basis of an asset.

These results are for. The chart below shows the expected depreciation for the next 10 years. As a real estate investor.

First one can choose the straight line method of. By entering a few details such as price vehicle age and usage and time of your. Also includes a specialized real estate property calculator.

Three factors help determine the amount of Depreciation you must deduct each year. Use this depreciation calculator to forecast the value loss for a new or used Toyota Land Cruiser. Depreciation asset cost salvage value useful life of asset.

Where Di is the depreciation in year i. The 2016 is our top pick for the best model year value for the Land Rover vehicles. Depreciation Schedule - Any farm machinery or building depreciation or other capital deprecation associated with this property.

A Toyota Land Cruiser will depreciate 43 after 5 years and have a 5 year resale value of 53440. With the 2016 you would only pay on average 44 of the price as new with. D i C R i.

The MACRS Depreciation Calculator uses the following basic formula. It provides a couple different methods of depreciation. See new and used pricing analysis and find out the best model years to buy for resale value.

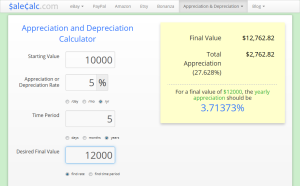

Appreciation Depreciation Calculator Salecalc Com

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

A Guide To Property Depreciation And How Much You Can Save

How To Use Rental Property Depreciation To Your Advantage

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator With Formula Nerd Counter

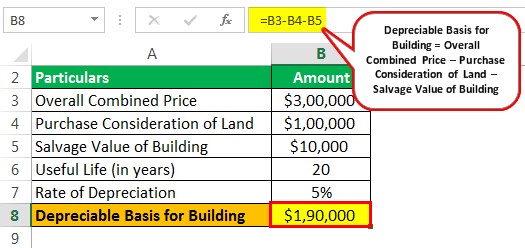

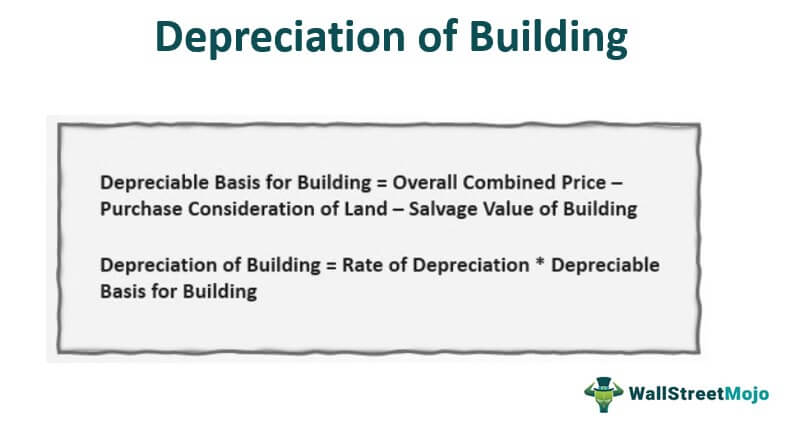

Depreciation Of Building Definition Examples How To Calculate

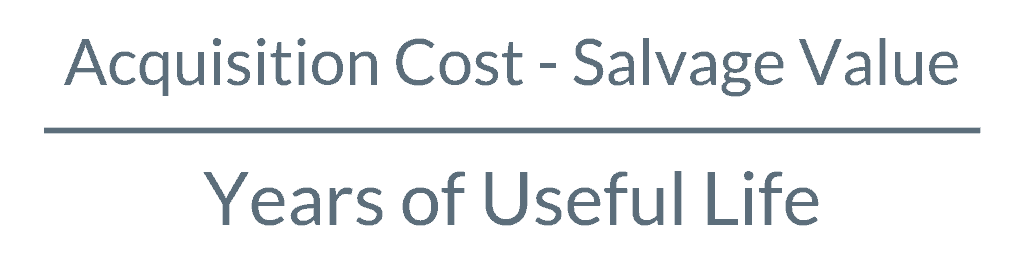

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Calculator And Definition Retipster

Straight Line Depreciation Calculator And Definition Retipster

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation Of Building Definition Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator Depreciation Of An Asset Car Property

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Schedule Template For Straight Line And Declining Balance