Excise tax calculator

Then you have to add Los Angeles sales tax 975. On top of that you charge an excise tax at 15 - so the sale goes to 23.

Car Tax By State Usa Manual Car Sales Tax Calculator

Under Used Cars select the make and model of your vehicle and click Go.

. California has a 6 statewide sales tax rate but also. Excise tax is assessed upon each transfer of vehicle all. Calculate excise tax based on a dollar amount.

The value of a. Youll be taken to a page for all years of the particular vehicle. This calculator is for the renewal registrations of passenger vehicles only.

Excise tax is often included in the price of the product. Delaware DE Transfer Tax. Navigate to MSN Autos.

Select the year of your. To calculate your estimated registration renewal cost you will need the following information. Departments Treasury Motor Vehicles Excise Tax Calculator.

1 2020 - March 31 2022 pdf. The State of Delaware transfer tax rate is 250. Motor Vehicle Tax Calculators.

Denotes required field. Contact 207283-3303 with any questions regarding the excise tax calculator. The tax rate is fixed at 25 per one thousand dollars of value.

How is the excise tax calculated. Local Real Estate Excise Tax - Rates July 1 2022 and after pdf Local Real Estate Excise Tax - Rates April 1 2022 - June 30 2022 pdf Rates Jan. How much will it cost to renew my.

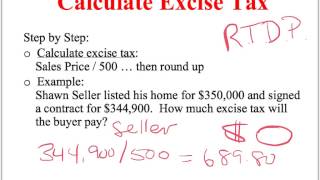

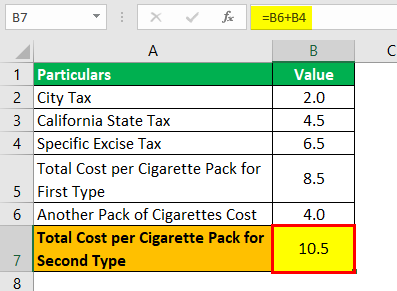

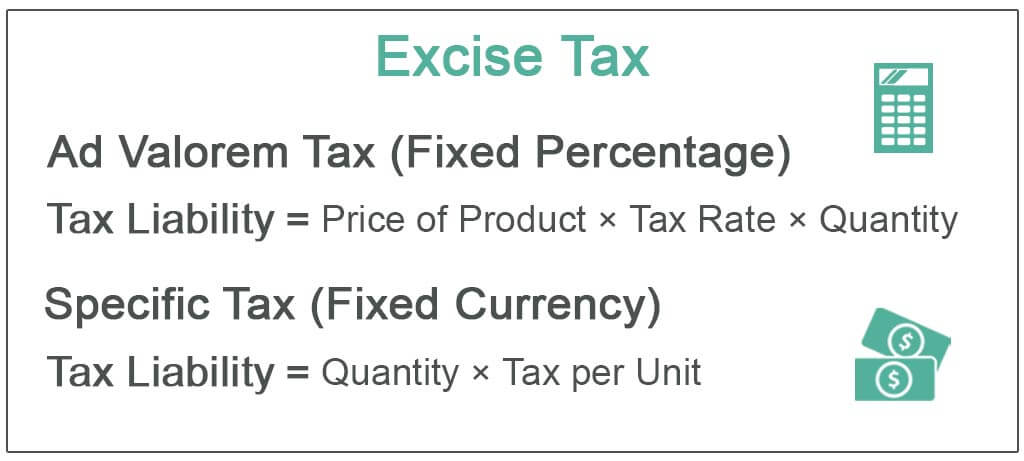

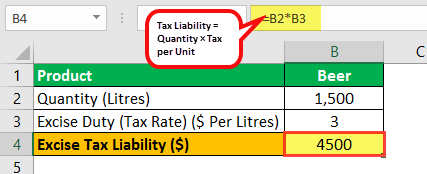

Excise Tax Calculator Excise Tax Calculator This calculator will allow you to estimatethe amount of excise tax you will pay on your vehicle. Excise tax is a tax paid when purchases are made on a specific good. Excise tax is calculated by multiplying the MSRP by the mill rate as shown below.

The excise due is calculated by multiplying the value of the vehicle by the motor vehicle tax rate. The sale of one gram of cannabis is 20. Excise Tax Calculator Excise Tax Calculator This is only an estimate.

Customs tariff Excise taxes Excise duty Softwood lumber products export charge Air travellers security. Four Wheeler Tax Learn More. The rates drop back on January 1st of each year.

Your exact excise tax can only be calculated at a Tag Office. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. YEAR 1 0240 mill rate YEAR.

Motor Vehicle Tax Property Tax Entertainment Duty Excise Duty Cotton Fee Infrastructure Cess Professional Tax. Calculator Mode Calculate. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price.

For example if real estate is taxed at 150 per 100 and the purchase price of a piece of property is 130000 then the excise. Enter your vehicle costeg. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Two Wheeler Tax Learn More. Current rates for customs duties and tariffs and the current excise tax rates. This method is only as exact as the purchase price of the.

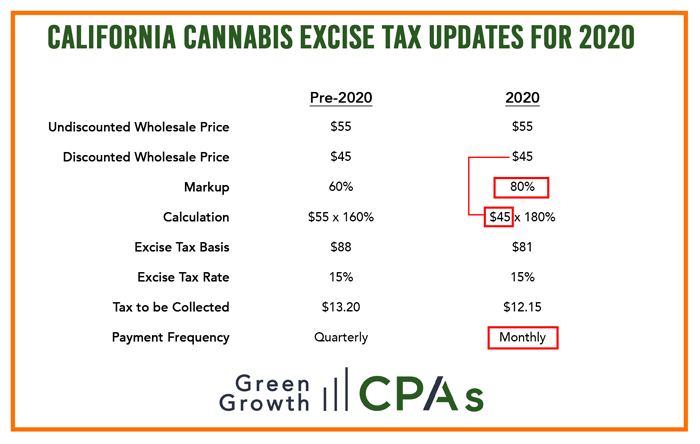

Cannabis Excise Tax Calculation Updates For 2020 Greengrowth Cpas

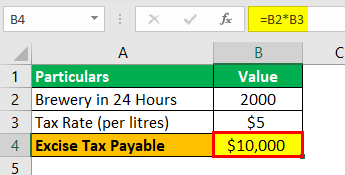

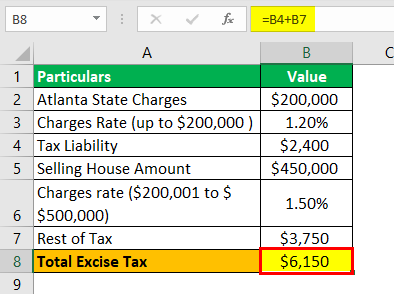

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Calculating Excise Tax Help With Closing Statments Youtube

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Excise Tax Definition Types Calculation Examples

Excise Tax Definition Types Calculation Examples

Blog California Marijuana Taxes

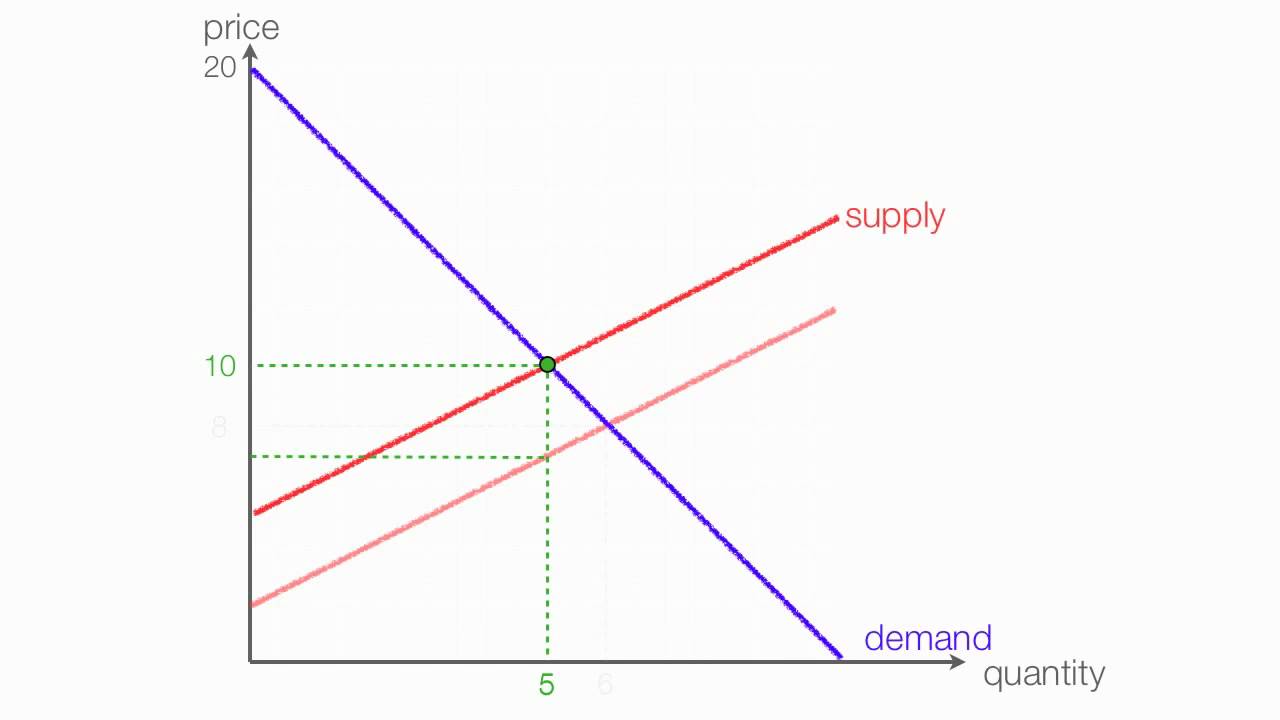

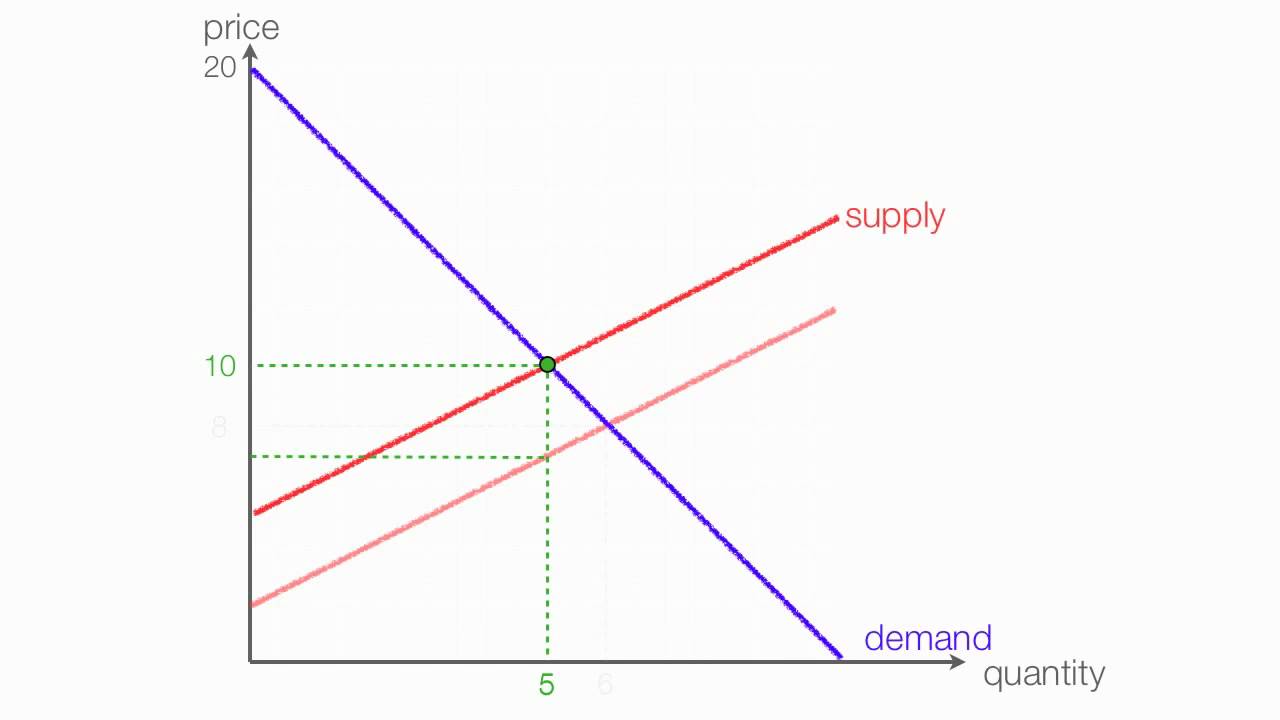

Microeconomics Excise Tax Effect On Equilibrium Youtube

Calculating Excise Tax Help With Closing Statments Youtube

How To Calculate Excise Tax And The Impact On Consumer And Producer Surplus Youtube

How To Calculate Cannabis Taxes At Your Dispensary

Excise Tax Definition Types Calculation Examples

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Excise Tax What It Is How It S Calculated